MEDICARE ENROLLMENT SPECIALIST

Woman, mother, wife, daughter, caregiver/CNA, Home Healthcare worker, office administrator, human resources, insurance verification specialist, all descriptive words of myself. However, I am now your advocate for your specific insurance needs.

In my 15 plus years of healthcare experience, I became inspired to assist patients and families with their questions and needs for the best and affordable insurance/Medicare plans. While working with assisted living facilities, skilled nursing facilities, hospitals, doctor’s offices, home health, hospice, in-home caregiver services, durable medical equipment companies, I have become aware of the challenges faced by patients, residents, and families. Through all this, I have determined that as your agent, I can help make these decisions easier and more efficient for you.

I am now dedicated to working for you and making certain that you are completely satisfied, from the effective date of your new policy to many years ahead.

Call or message me with any questions or a quote anytime.

Janelle Brown – Emerald Insurance – 602-434-8963.

You can also contact me through email – janelle@emeraldinsurancegroup.com

When you understand the basics of Medicare, you will quickly learn that there isn’t a “one size fits all” plan.

We are here to educate you about all your choices.

For those who have turned 65 and become eligible for Medicare, there are lots of decisions to make about how to use the program in the best way to meet your healthcare needs. First, you will need to determine whether you will opt to use Medicare Part A & B or choose Medicare Part C instead. Those who choose Medicare Part C, have lots of coverage options offered at many different price points by various private insurance companies.

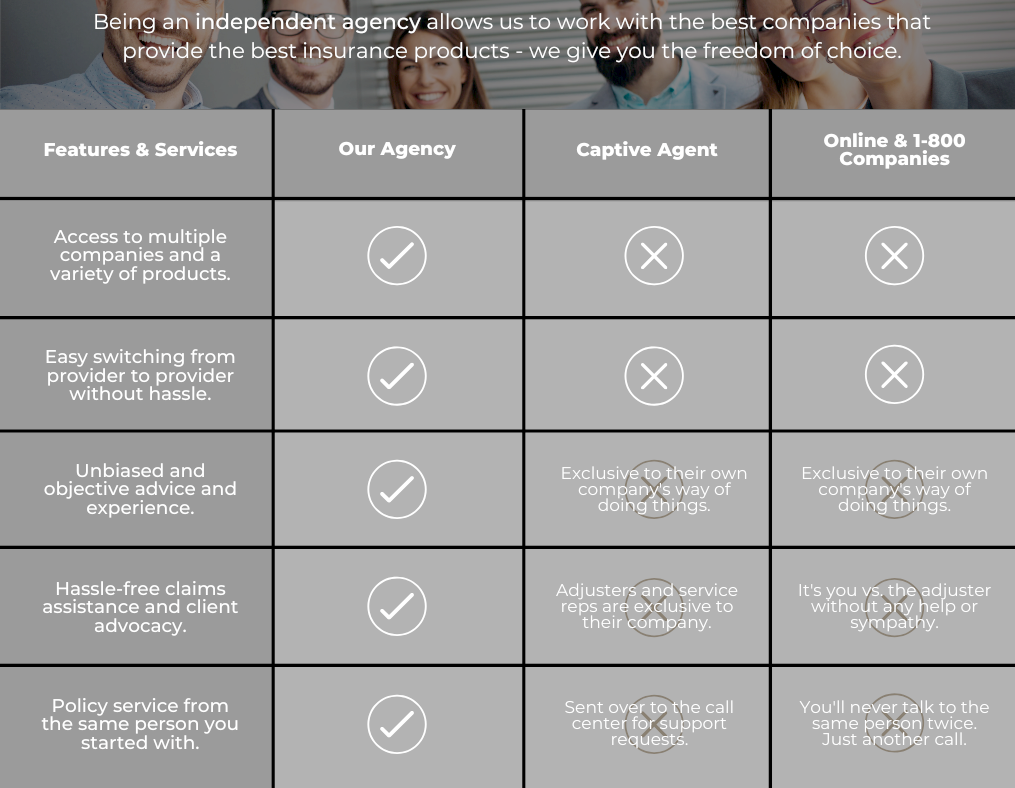

The work of your independent insurance agent doesn’t just end after you purchase a policy. Your independent agent is always there to answer questions and can help you address your policy concerns, changes, and renewals in the coming years.

They can help you to annually review your coverage and continue to select a correct plan based on your changing needs.

The rate offered by your insurer for the policy already accounts the commission for your agent or broker.

It doesn’t cost you anything to get the help you need from a well-informed, experienced and licensed independent agent, even if you don’t decide to purchase the policy.