Home / Medicare Basics

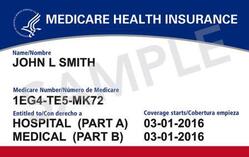

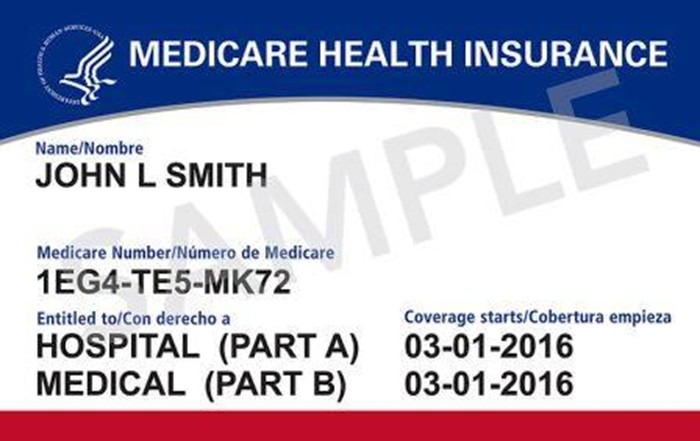

Part A is an original component of Medicare offered by the federal government.

Part A coverage includes inpatient hospital stays, some home healthcare, hospice care and skilled nursing facilities.

Part B is an original component of Medicare offered by the federal government.

Part B coverage includes certain doctor office services, outpatient care, medical supplies, and preventative health services.

Part C includes plans that customize benefits from Part A and B to your individual needs.

These plans are offered by private companies and the plans must be approved by Medicare. Medicare Advantage Plans include Health Maintenance Organizations (HMO’s), Preferred Provider Organizations (PPO’s), Fee-for-Service Plans, Special Needs Plans, and Medicare Medical Savings Account Plans.

Medicare Prescription Drug coverage is available only through private insurance companies.

It is often purchased as a standalone policy to go with a Medicare supplement policy.

Most Medicare Advantage plans include a Medicare Prescription Drug as a part of their integrated health insurance approach.

When you understand the basics of Medicare, you will quickly learn that there isn’t a “one size fits all” plan. We are here to educate you about all your choices.

Choices include:

Original Medicare includes:

Medicare Advantage Medicare Part C or Medicare Advantage. Medicare Advantage plans to combine Part A and Part B benefits into one plan. Most include prescription drug coverage Part D and offer additional benefits (vision, dental, hearing, etc) as well, often with no monthly premium. Medicare Advantage plans are offered by private insurance.

Are designed for people with specific health care needs, including nursing home residents, those with chronic conditions, and people who are eligible for both Medicare and Medicaid. May provide care managers or nurse practitioners to help members get the care they need. Usually have plan-specific eligibility requirements.

Medicare supplement insurance, or Medigap, is private insurance that helps pay for some of the out-of-pocket costs not paid by Original Medicare (Part A and Part B). Supplement plans are medically underwritten, based on age and health to determine eligibility and monthly premiums. There are ten plans standardized by the federal government. Each is labeled with a letter. All plans with the same letter offer the same benefits. Massachusetts, Minnesota, and Wisconsin have different plans.

You can get prescription drug coverage as a standalone Part D plan or with a Medicare Advantage plan that includes prescription drug coverage. There is a penalty for not signing up for Part D when it is first available to you.

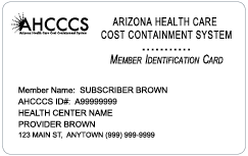

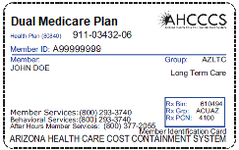

Dual Medicare Plan works together with your AHCCCS/ALTCS (Medicaid) plan to offer you more health coverage. You’ll keep all your AHCCCS/ALTCS (Medicaid) benefits. Plus, you could get many extra benefits and features at no extra cost. If you have both Medicare and AHCCCS/ALTCS (Medicaid), you may be able to get this plan.

Money to purchase items such as incontinence, vitamins, shampoo..

Coverage & money to pay for dentures and dental work

Money to help buy glasses

Eligibility requirements.

If you are under the age of 65, you may still be eligible for Medicare under certain circumstances, including the following.

If you meet the requirements, you are eligible to enroll in Medicare. It is important to note that once you meet eligibility requirements, you are not automatically enrolled in Medicare, once you meet the eligibility requirements you must meet the deadlines to avoid penalties or lapses in coverage. More information on the enrollment process is covered in the “How to get started” section.

If you meet eligibility requirements for Medicare, complete the enrollment process before the deadlines, and are approved by the federal government, you can receive Part A Medicare benefits at no premium.

You may purchase Part B Medicare benefits if desired. Payments are deducted from you Social Security, Railroad Retirement, or Civil Service Retirement benefits. If you do not receive any of those benefits, you will be billed for your Part B premium every 3 months.

Emerald Insurance adds the most value to your healthcare benefits by customizing your Part C and Part D Medicare benefits for complete healthcare coverage, Part A and B included. Emerald partners with well-known healthcare companies. These companies offer a wide range of products including Health Maintenance Organizations (HMO’s), Preferred Provider Organizations (PPO’s), Fee-for-Service Plans, Special Needs Plans, and Medicare Medical Savings Account Plans.

Emerald will help by taking the time to determine the plan that best meets your medical needs and budget.

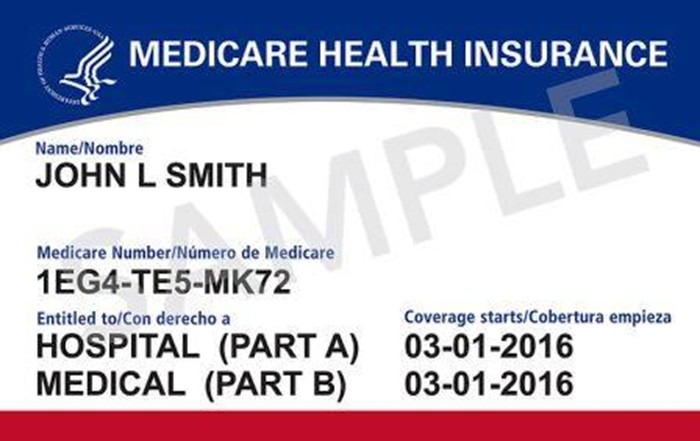

Your first step is to enroll in Original Medicare, Parts A & B.

This is done through Social Security. You can call them at 1-800-772-1213, use their website at https://www.ssa.gov/, or walk into a local Social Security office to enroll in Medicare

Some people get Part A and Part B automatically:

If you’re already getting benefits from Social Security or the Railroad Retirement Board (RRB), you will automatically be enrolled in Original Medicare (Part A and Part B) starting the first day of the month you turn 65.

If You Are 65 and Not Getting Social Security or RRB:

If you’re not already getting benefits, you should contact Social Security about three months before your 65th birthday to enroll in Medicare. You should sign up for Medicare even if you don’t plan to retire at age 65. You may delay Part B if you will continue medical insurance coverage through a current employer’s group health plan. Once you retire (or lose your employer plan), you will have a special election period to enroll in Part B. As long as you maintain creditable coverage through your employer, you will not incur a Late Enrollment Penalty.

Decide if you need additional coverage. You can choose 2 options:

Option 1: Add one or both of the following to Original Medicare

Option 2: Choose a Medicare Advantage plan